The bond must equivalent the newest tax due along with attention to the date out of percentage while the realized because of the Irs. Factual statements about the form of bond and you will security inside it is also be purchased from the TAC office. For individuals who must rating a cruising or deviation permit, you should file Mode 2063 or Setting 1040-C. If certificate out of compliance is actually closed from the a realtor from industry Assistance Area Manager, they certifies your U.S. taxation personal debt was fulfilled based on offered information.

Losses away from considered transformation need to be taken into consideration to the extent if you don’t provided less than You.S. Yet not, section 1091 (regarding the disallowance out of losings to the clean conversion process out of inventory and securities) doesn’t use. The web acquire you have to otherwise include in your income are shorter (although not lower than no) because of the $866,100 for many who expatriated casino royal vegas review otherwise ended abode inside the 2024. Around you expatriate, you’re susceptible to taxation on the internet unrealized get (or losings) in your assets because if the house or property ended up being ended up selling for their fair market value at the time prior to your expatriation go out (“mark-to-business income tax”). Which pertains to most kind of property passions your kept for the the newest date out of relinquishment out of citizenship otherwise cancellation from house.

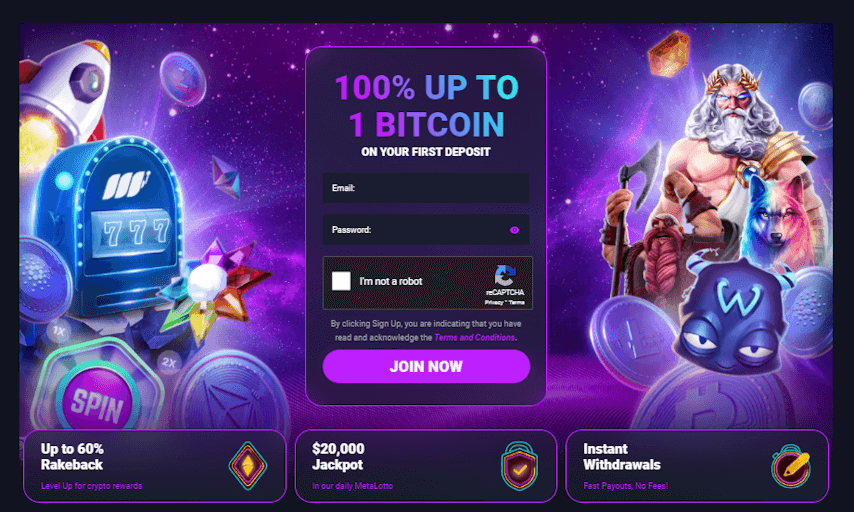

Secure Payment Tips from the $5 Put Casinos

The rest $75,100000 is actually due to the last step 3 home of the season. While in the those individuals residence, Deprive has worked 150 weeks inside the Singapore and thirty day period from the You. Rob’s occasional efficiency of functions in the us don’t cause line of, independent, and you can persisted amounts of time. Associated with the $75,000, $twelve,five hundred ($75,100000 × 30/180) is You.S. supply money. When you’re processing the revised return responding to an excellent billing notice you obtained, you will always discover charging you observes up to their revised income tax return is accepted.

To learn more about when you should file and you can where to document, find a bankruptcy proceeding. This can be real even when your revenue is exempt from You.S. income tax on account of a taxation treaty, consular contract, or global agreement. At times, your don’t need to report the amount of money on your own Function 1040 or 1040-SR since the earnings was exempt from U.S. income tax under a great pact. Go into the amount where treaty advantages are advertised, inside the parentheses, for the Agenda step 1 (Mode 1040), line 8z. Go into “Exempt income,” title of your treaty nation, and the pact blog post that provides the newest exclusion. Resident aliens basically do not qualify for income tax pact pros as the extremely income tax treaties have a «preserving term» one saves or «saves» the right of one’s All of us in order to taxation its people and citizens since if the brand new income tax pact had not come in impression.

Withholding to your Idea Income

Practical cause try assumed whenever 90% of the tax revealed for the return try repaid from the brand-new deadline of one’s return. If, once April 15, 2024, the thing is your imagine out of income tax owed is actually too lowest, afford the a lot more tax as fast as possible to prevent otherwise get rid of after that buildup away from charges and you may focus. Proceed with the instructions lower than to work the level of an excessive amount of SDI to enter for the Form 540, range 74.

Key Features

The brand new urban commuter transportation mobility tax (MCTMT) try enforced to the self-working those with net earnings away from mind-work allocated to Metropolitan Commuter Transportation District (MCTD). Get in touch with the fresh shared fund for more information on appointment the newest fifty% investment specifications and you will figuring their deductible subtraction (or no). When you have accomplished Setting It-225, import the fresh amounts in order to create They-203 as directed to your Mode It-225.

- In order to recover a hundred% of the shelter dumps, be sure to bring photos of your own following the section (and you may put reviews on the video clips of each and every place).

- Attach federal Function 8886, Reportable Transaction Revelation Declaration, for the straight back of your California income tax go back as well as any almost every other supporting dates.

- Get into one to part of the government count which you acquired while the a good nonresident of a corporate, change, or profession you continued within the New york Condition.

Should your company is molded lower than three years before the declaration, fool around with the full revenues ever since it absolutely was molded. Influence the brand new area which is You.S. origin money by multiplying the new dividend by following the tiny fraction. Bob and you can Sharon Williams try married and both are nonresident aliens at the beginning of the season. Inside Summer, Bob turned a citizen alien and you may stayed a citizen on the rest of the season. Bob and Sharon both choose to be handled since the citizen aliens because of the examining the right field to the Function 1040 or 1040-SR and you will tying a statement on the mutual come back.

Married/RDP Processing On their own

Review the new tips to possess Function It-216 and you can, for those who meet the requirements, over Setting It-216 and you will import extent away from Mode They-216 to form It-203, line 52. When you are at the mercy of any taxation, finish the compatible models and you can Part 2 away from Setting They-203-ATT. Transfer extent away from Mode They-203-ATT, line 33 Internet most other Ny State taxation, in order to range 44. In case your Internal revenue service try calculating your own federal attained money credit, create EIC on the container left of your own money column and leave the cash line empty on the web 43. You should complete Setting They-203, contours forty five, 47, forty-two, 51 thanks to 57, and you can sixty thanks to 65, but never complete outlines 66 due to 71.

You might merely subtract a good nonbusiness casualty otherwise theft loss in the event the it is owing to a great federally announced disaster. You may also be eligible for the new exclusion described before for those who see both of next conditions. You can even qualify for the fresh exemption explained more than if both of another implement. For many who expatriated once June 16, 2008, you are addressed while the a shielded expatriate, plus the expatriation legislation lower than area 877A affect you if the your satisfy all following criteria. The expatriation day is the day your surrender U.S. citizenship (in the case of an old citizen) otherwise terminate the long-name house (in the example of a former You.S. resident). Report on your own go back the level of OID found for the Setting 1042-S for those who ordered your debt device at the brand-new issue.